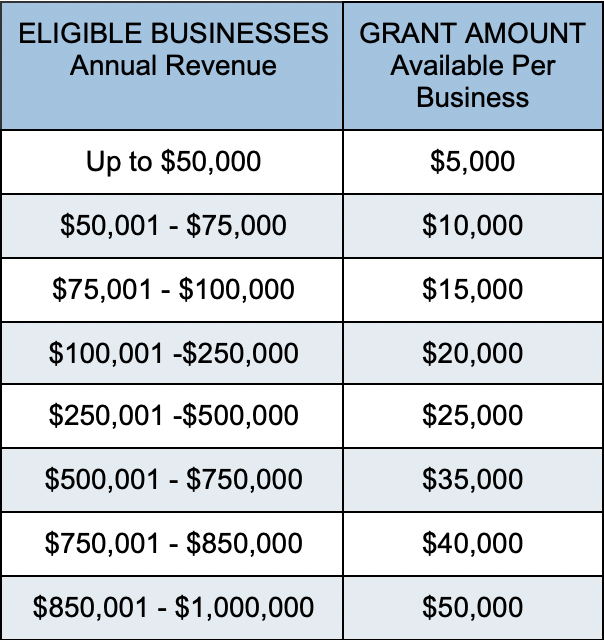

Pennsylvania announced a new program that will give out 200 million dollars to small businesses impacted by the COVID-19 pandemic. The COVID-19 Relief Pennsylvania Statewide Small Business Assistance Program will provide grants to businesses with less than one million dollars in gross revenue. The amount of the grant varies and depends on the gross revenue of the business based upon the business’s last tax return. The following is a list of the amount of the grant a business can receive:

Source: https://pabusinessgrants.com/

In order to qualify for the grant, the business applying must be physically located and generating at least 51% of the business revenue in Pennsylvania. The business must also have less than 25 full-time employees prior to February 15, 2020. Unfortunately, non-profits, churches or other religious institutions or government-owned entities are not eligible for the grant. In addition, businesses that are in active default with taxes or fees owed to the Commonwealth or the Internal Revenue Service (IRS) are not eligible for the grant.

The funds can only be used for specific expenses and the business must prove a loss in revenue due to the pandemic. Clarification on how the funds can be used has not yet been released, but we do know that the funds must be used for costs incurred specifically due to the pandemic. Some examples of how the funds may be used should include a restaurant buying tables, chairs or a tent to for outside dining or a business buying employees laptops to work from home.

The application for the grant will be available on June 30, 2020 and will be open for ten (10) business days. This is not a first-come, first-serve grant. In addition, there will be additional windows to apply for a grant after this round closes. Priority will be given to the following businesses:

- Owned and operated by low and moderate-income people; or

- Located in areas of need including areas with a population having incomes significantly below the median income level, high levels of poverty, higher than average unemployment rates, or significant population loss.

- Types of businesses that were most impacted by the economic shutdown and experienced the greatest revenue losses.

- Women-owned businesses.

To apply or for more information visit https://pabusinessgrants.com/.